What Exactly Is Mortgage APR?

February 23, 2024

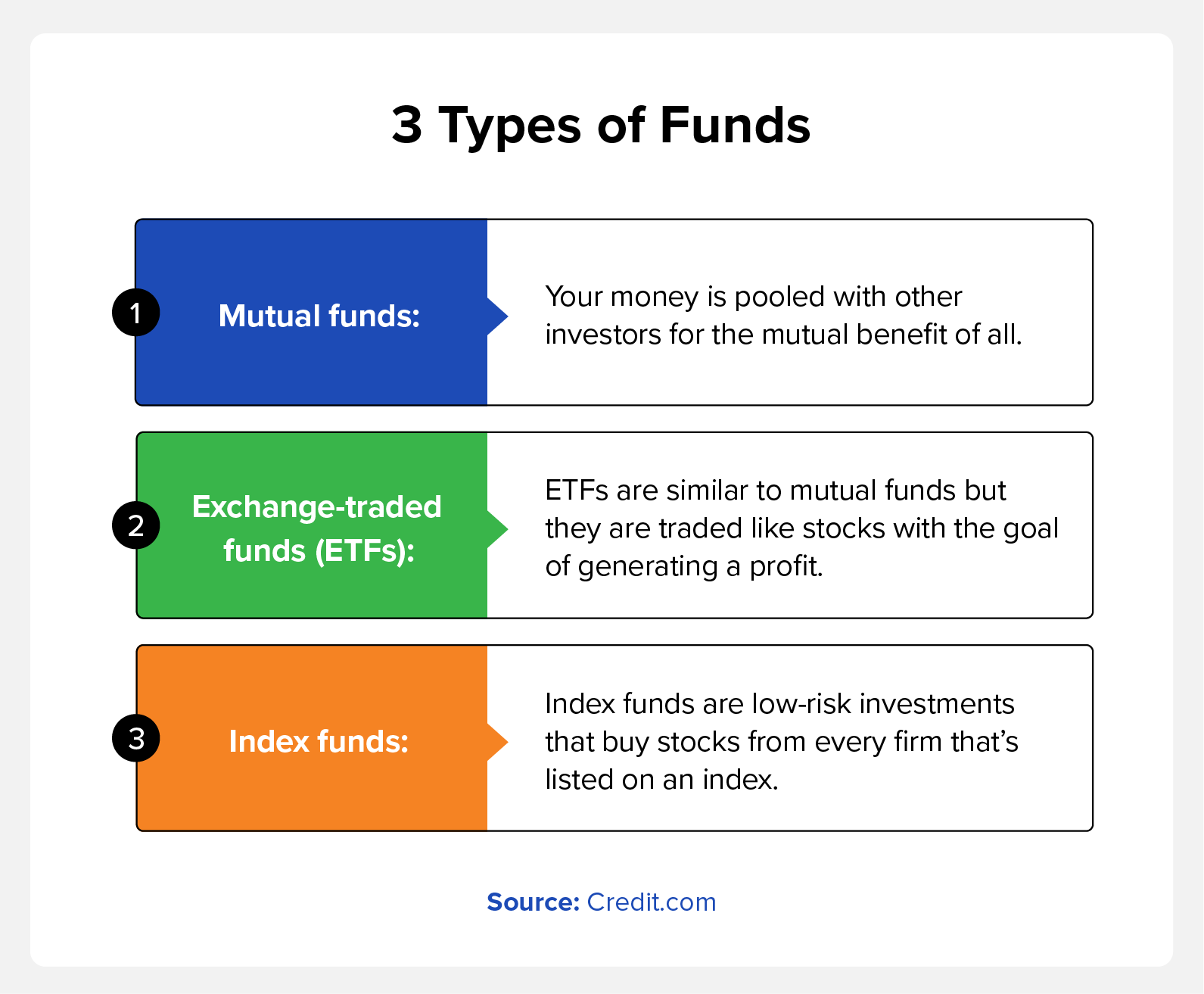

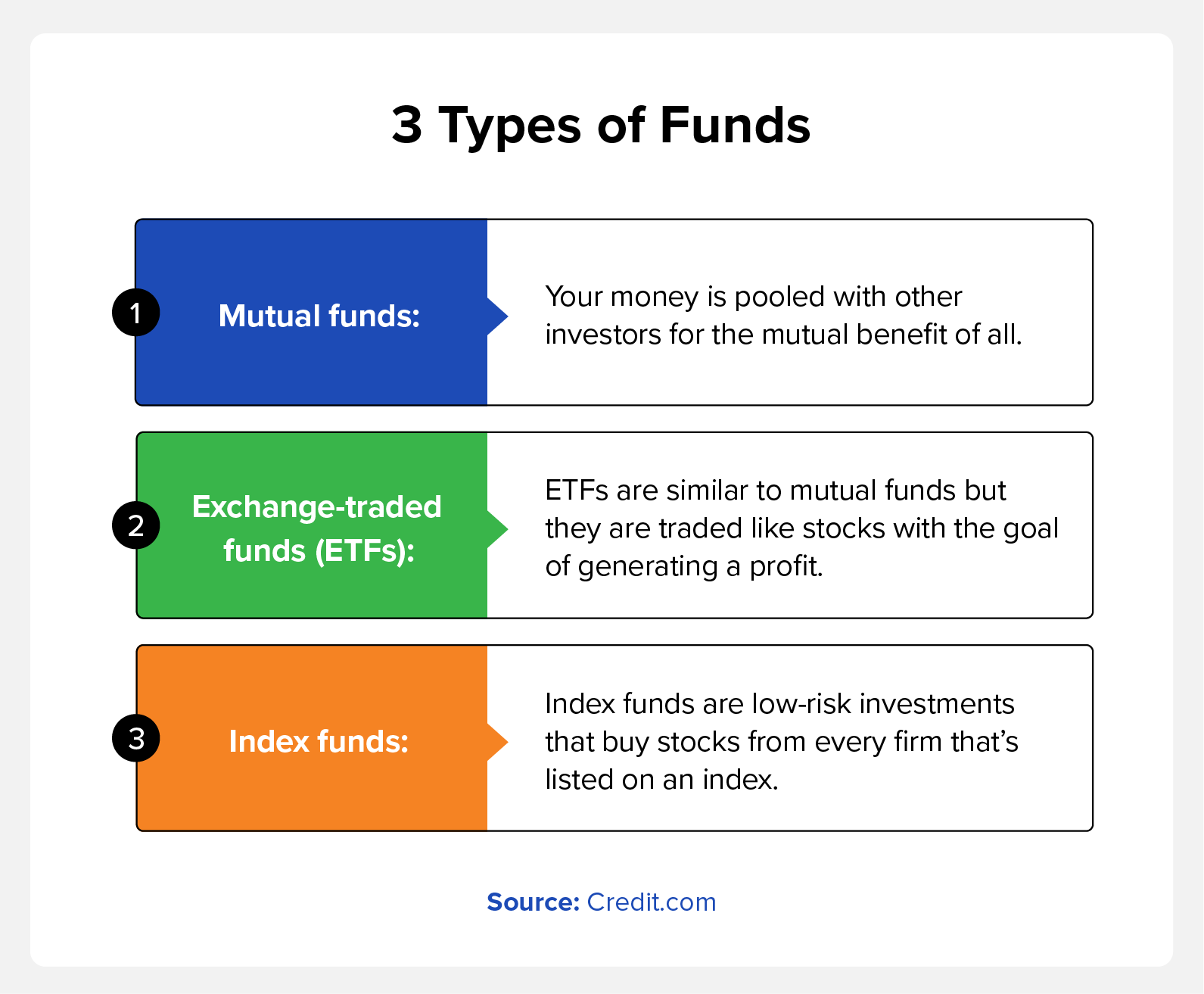

An expense ratio is how much it costs to operate a fund compared to the total value of its assets. The lower expense ratios between 0.5% and 0.75% are ideal.

An expense ratio is how much it costs to operate a fund compared to the total value of its assets. The lower expense ratios between 0.5% and 0.75% are ideal.

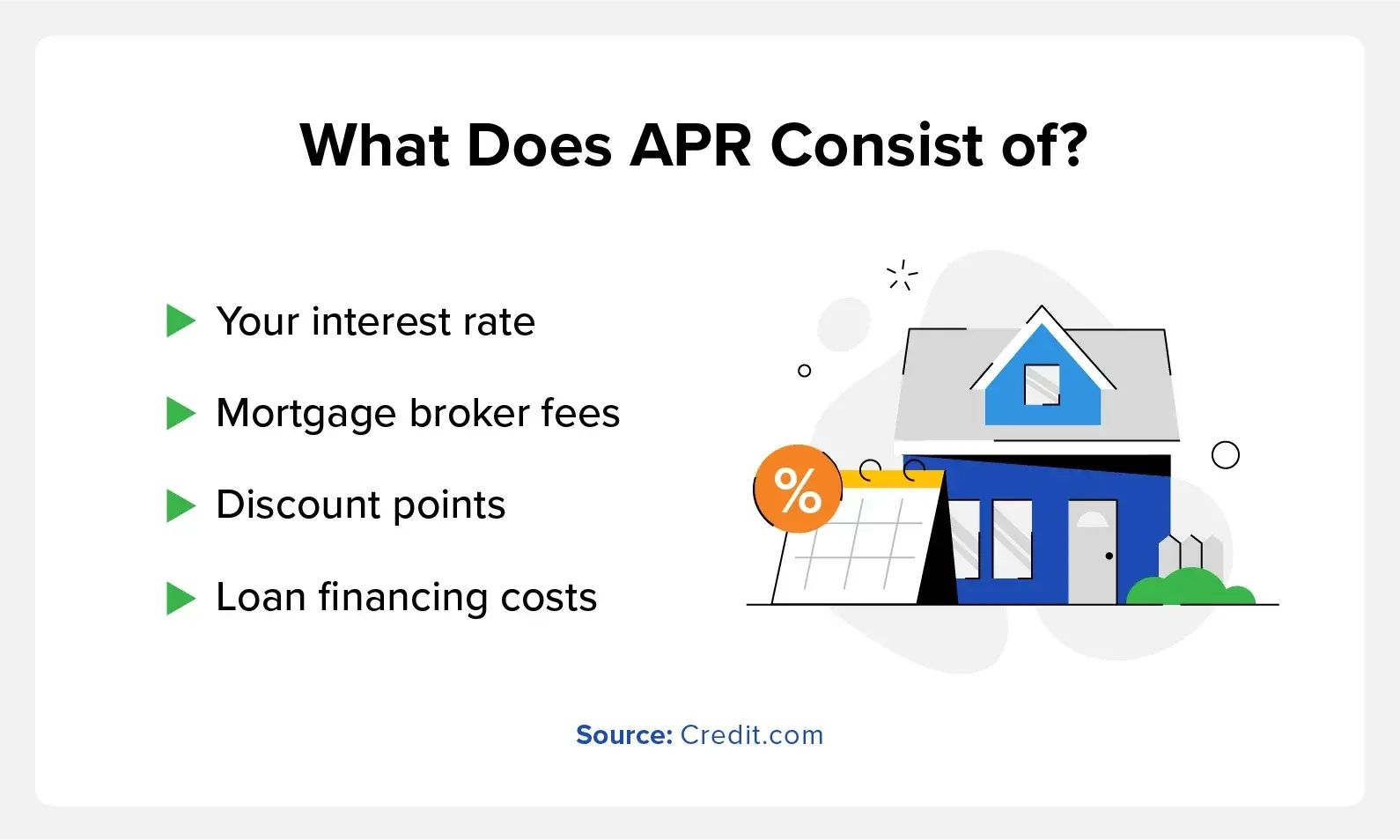

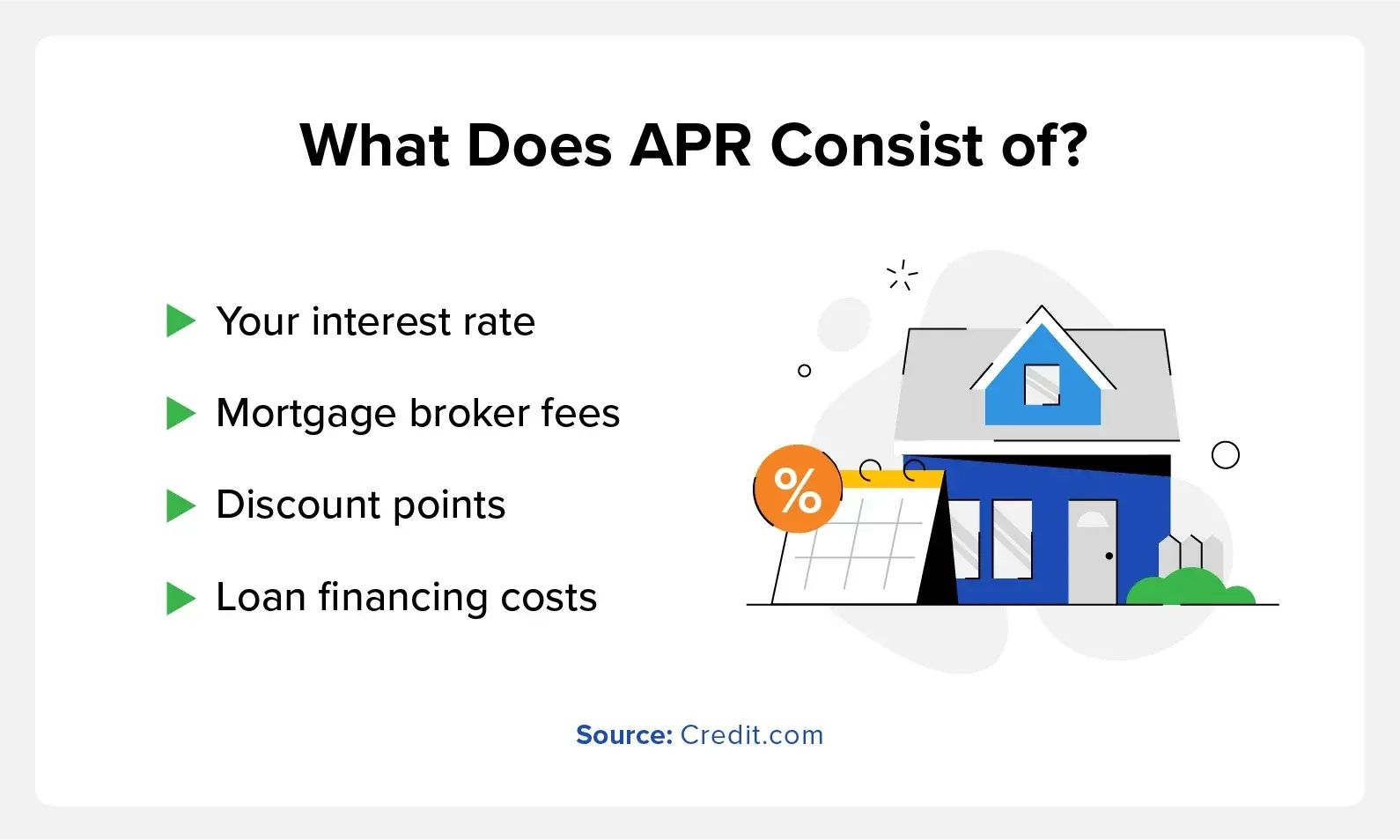

Mortgage APR refers to the total amount of interest you’ll pay on your mortgage yearly. Learning how to calculate APR can save you a lot of money over time.

If you’ve filed for bankruptcy, you might ask, “Can you buy a house after bankruptcy?” In this article, we explain how to get a mortgage post-bankruptcy.

Chase offers several credit cards for consumers with different needs. Read this review to find out if the Chase Sapphire Reserve® is right for you.

Debt relief options and debt settlement shouldn’t negatively affect your credit score. However, closing your oldest accounts can have a big impact.

Car insurance is a necessary expense for many, but it’s a financial burden for some. Learn why your car insurance is so high and how to make it cheaper.

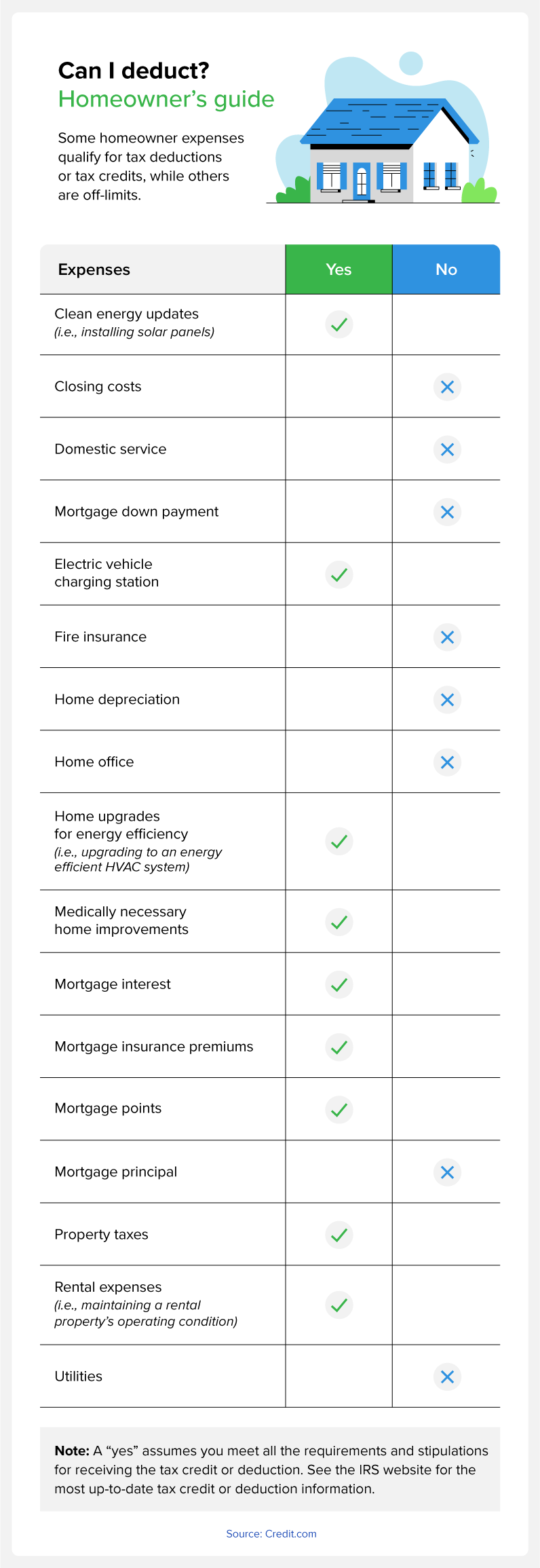

You can qualify for tax breaks for buying a house. Common tax breaks for homeowners include the home mortgage interest deduction and the property tax deduction.

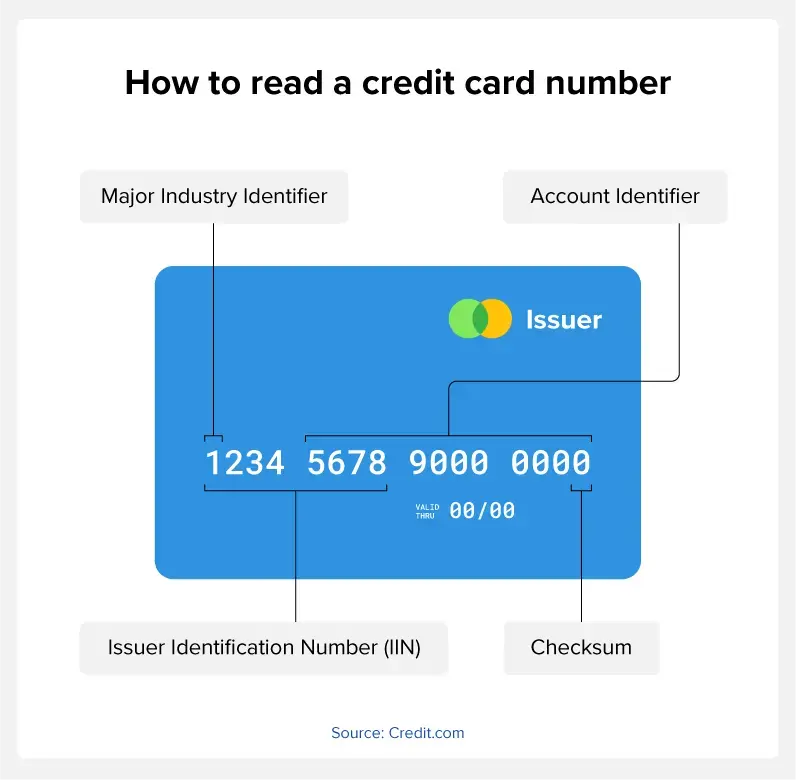

Did you know the numbers on your credit card provide a lot of information? Learn to decipher credit card numbers with our quick guide.

A nonjudicial mortgage foreclosure can take about 120 days, or four months, to complete. Judicial foreclosures, however, vary depending on your state.

What is a prepaid debit card? Learn more about prepaid debit cards, why and how you might use them, and their advantages and disadvantages.