Tax Credits vs. Tax Deductions: What’s the Difference?

April 09, 2024

Nikita Walker (she/her) is the content manager for Credit.com and an editor with a passion for financial justice. She's been a professional writer and editor for more than fifteen years, working to make all the content she touches accurate and accessible. She most enjoys creating easy-to-understand financial guides for people just starting their financial journeys and connecting with other experts to expand her own knowledge. When she's not editing, she's reading, checking on her little free diverse library, or working with her local mutual aid organization.

Before you file a tax return, you need to know the difference between a tax credit vs. a deduction. Here’s how to tell these two tax terms apart.

In most cases, cosigners are not listed on the title unless they are also listed as co-owners of the vehicle.

Getting a big tax refund this year? Get some tips for using your tax refund to build credit or take other responsible financial actions.

Can you fix your credit score in a week? Probably not. But don't give up - it is possible to fix and improve your credit faster.

Why is a credit union better than a bank? Discover the differences between these two financial institutions and learn more about how credit unions work.

Refinancing gives you the opportunity to reduce your payment or get better loan terms. But is it good to refinance your car?

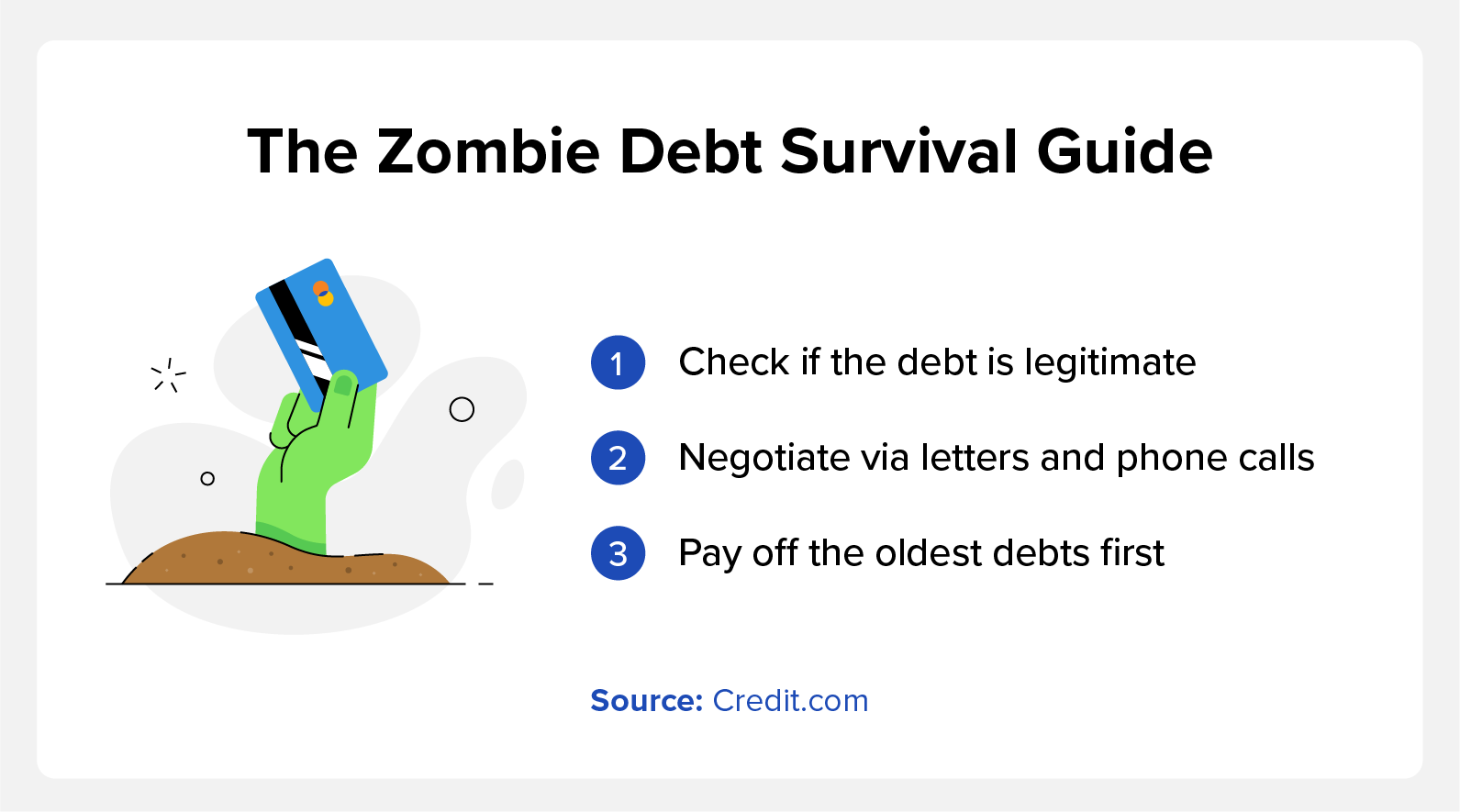

Zombie debt broadly refers to past debts that are still affecting you. An example of zombie debt is a three-year-old loan you’ve already paid off.

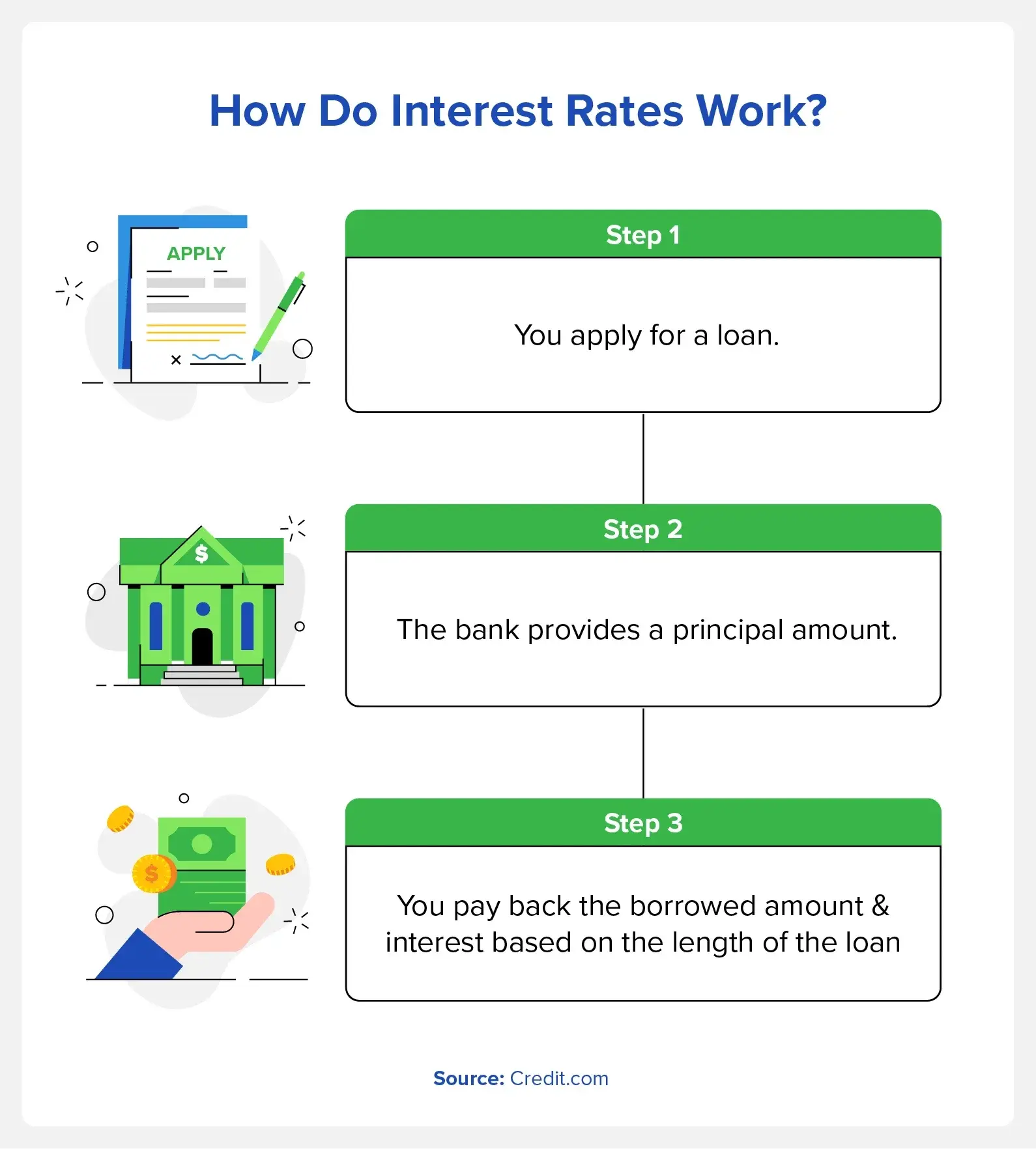

Wondering "How do interest rates work?” When lenders loan money, they charge interest until the loan is repaid. Read on to learn how interest rates are calculated.

What is a secured credit card? Find out more about how secured credit cards work and how getting one may help build or rebuild your credit.

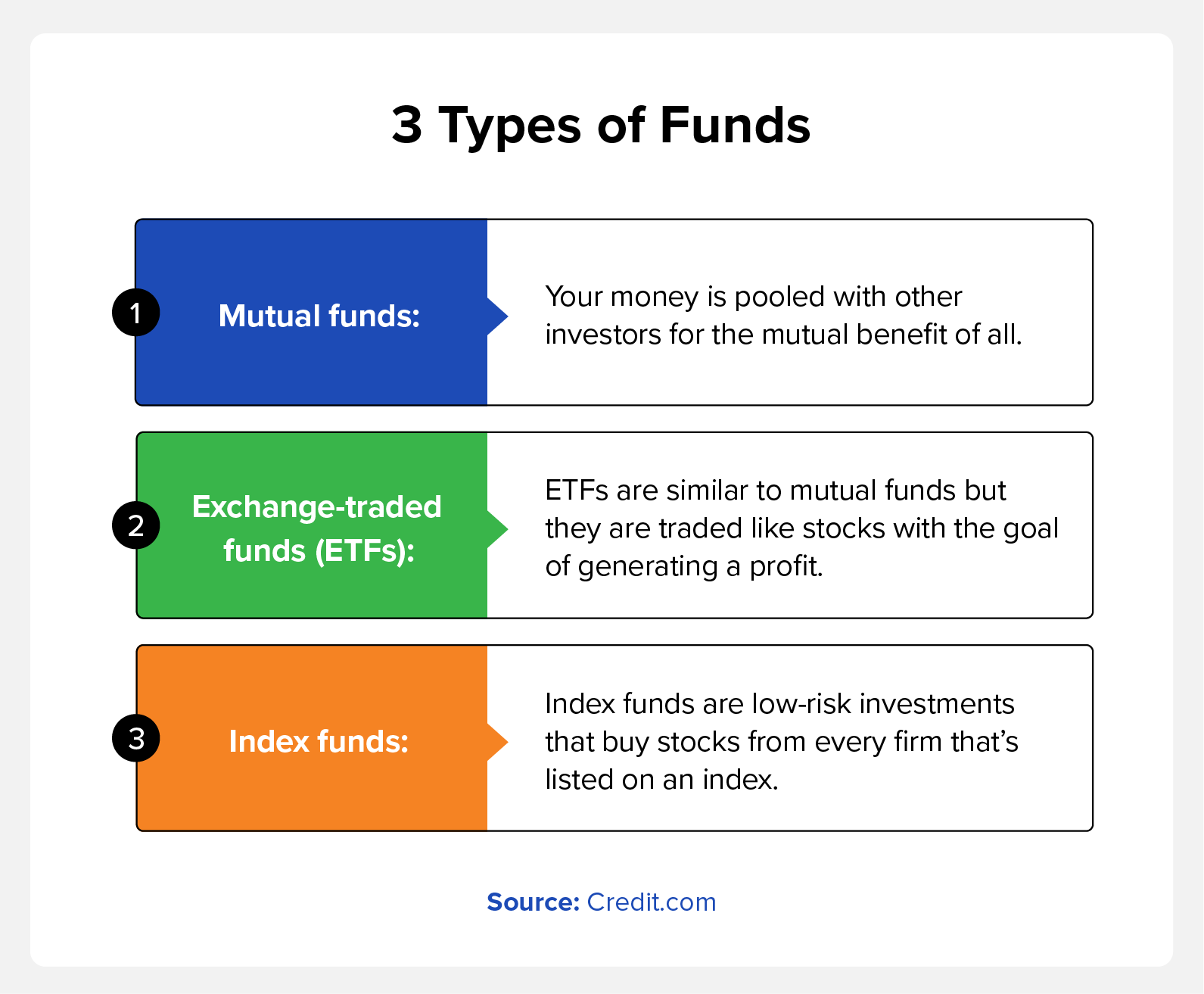

An expense ratio is how much it costs to operate a fund compared to the total value of its assets. The lower expense ratios between 0.5% and 0.75% are ideal.